Human Resource Management Software

Product Details:

|

Software Version |

5.0.1 |

|

Brand |

ShreeHRMS |

Shree Web Based Payroll Software is very easy, flexible and user-friendly Web based Payroll Management software that takes care of all your requirements relating to accounting and management of employee’s Payroll. This versatile, user friendly, package, offers user defined Earning / Deduction / Loan Heads & Calculation Formulae / Tables. The package generates all the outputs & statutory reports required by a Payroll application.

• Flexible Structure building capability of Earnings & Deductions

• Flexibility to add or modify any number of Salary Components - Earnings & Deductions

• User Defined Entry Field with unmatched flexibility for Formula, percentage or Customized Calculation

• Taxable & Non Taxable Earnings for Income Tax Calculations

• Payslip / Non Payslip Component

• Calculation based on Attendance

• Monthly or Yearly Payments

• Frequency of Salary Head

• Also compute various other components that do not appear in Payslip

• Payroll Processing

• Input information for all newly joined employees and resign left employees

• Create a new payroll month & Process Salary

• Over-ride facility for any Salary components

• Salary on Hold & Freezing of Salary in case of Termination of Employees

• Process by Exception - you only need to enter Pay and/or deduction information when there are changes

• Pro-rata calculations for employees based on Absenteeism

• Process & Print Payslips for groups or for selected employees

• Lock month facility to avoid changes in Processed Data

•

• Reimbursement Management

• Multiple Reimbursement Components like Medical , LTA & Customizable Reimbursement Components

• Upper limits can be specified – Employee wise or Grade wise

• Annual Limits or Monthly Accruals

• Opening Balance, Entitlement, Amount Reimbursed and Balance amount can be checked

• Reimbursement Payslips, Bank transfer statement for Reimbursement Component

• Arrears Calculation

• Arrears calculation for any previous period / Retrospective effect

• Separate Payslips can be generated for the Arrears Components

• Bank transfer statement for Arrears Component

• PF Calculation & Reports

• User defined PF Rate of Deduction for Employer & Employee

• Employee & Employer Contribution

• ESIS Calculation & Reports

• User defined ESIC Rate of Deduction for Employer & Employee

• ESIC applicability check at Employee Level

• ESIC Register, Form 5, 6 & Challan

• Professional Tax

• User definable State wise Slab

• PT applicability check at Employee Level

• Form III & Challan

• Income Tax Management

• Auto calculations of Exemptions & Deductions and compute income tax payable for the entire year & the tax to be paid this month

• Auto calculation of TDS based on Projections

• Income Tax Projections with the options to deduct projected tds from Monthly Salary

• Prints Form 16, 12BA & Online Challan 281

• Quarterly e-TDS Return as per the NSDL format

• Income Tax Projections can be emailed in PDF format

Additional Information:

- Pay Mode Terms: T/T (Bank Transfer),Other

Other Products Range

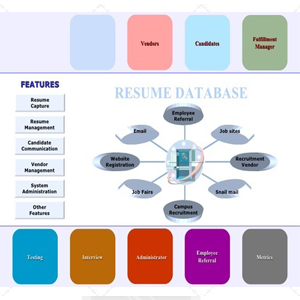

Recruitment Management Software

Read more...

Performance Management System

Read more...